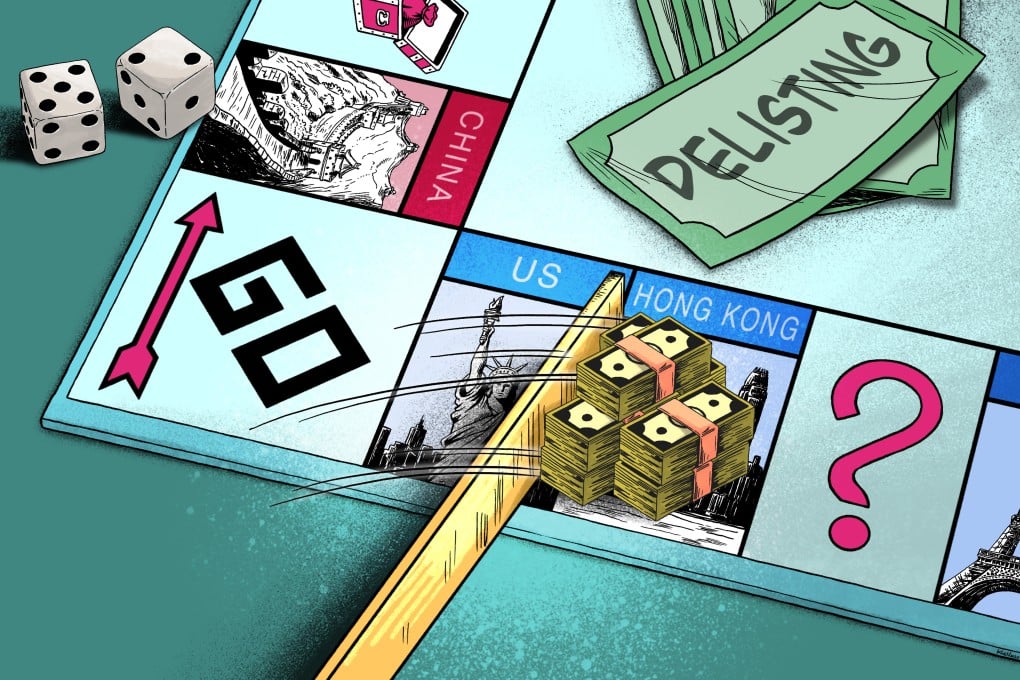

Hong Kong prepares for a grand homecoming as mainland firms face US delisting threats

Delisting pressure on US-listed companies from the mainland could be a jackpot for Hong Kong markets

A month ago, Patrick Tsang, the CEO of Deloitte China, learned that the US government had declined to rule out the possibility that Washington could delist Chinese stocks from American exchanges.

Around 286 mainland companies trading in the US came under threat of delisting after Treasury Secretary Scott Bessent said in early April that “everything’s on the table”, as worries about decoupling emerged amid a US-China tariff war.

Tsang immediately rounded up a capital markets team at Deloitte to produce proposals on how Hong Kong could prepare for the situation.

Last week, he submitted a paper to the Chief Executive’s Policy Unit, outlining four major strategies to bolster Hong Kong’s financial preparedness, including simplifying listing procedures and finding funding for these companies.